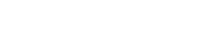

The age-old debate of owning a home versus renting continues to be a hot topic in the realm of personal finance and lifestyle choices. Each option comes with its own set of advantages and disadvantages, catering to different preferences, financial situations, and life stages. In this comprehensive exploration, we will delve into the benefits of owning a home and compare them to the advantages of renting, providing readers with valuable insights to help them make informed decisions about their living arrangements.

Benefits of Owning a Home

Building Equity

One of the primary advantages of owning a home is the opportunity to build equity. Unlike renting, where monthly payments contribute solely to the landlord’s wealth, homeownership allows individuals to accumulate equity as they pay down their mortgage. This equity can be a valuable asset, serving as a source of financial stability and a potential investment for the future.

See Also: Exploring Affordable 3 Marla Plots in Lahore

Stability and Predictability

Homeownership provides a sense of stability and predictability that renting may not offer. Fixed-rate mortgages ensure that monthly mortgage payments remain constant, allowing homeowners to budget more effectively over the long term. This stability can be particularly beneficial in times of economic uncertainty, providing a sense of security and control over housing expenses.

See Also: Blue World City Islamabad (UPDATED – 2024) Payment Plan

Personalization and Creative Freedom

Homeownership grants individuals the freedom to personalize their living spaces to suit their tastes and needs. Home improvements, renovations, and landscaping projects allow homeowners to invest in and enhance the value of their property. This creative freedom can lead to a stronger sense of attachment to the home, fostering a deeper connection to the community and neighborhood.

Tax Advantages

Homeownership often comes with various tax benefits. Mortgage interest payments and property tax deductions can significantly reduce the homeowner’s taxable income. These tax advantages can translate into substantial savings and contribute to the overall affordability of homeownership.

See Also: Blue World City General Block Phase 2

Long-Term Investment

Real estate has historically proven to be a solid long-term investment. Property values tend to appreciate over time, providing homeowners with the potential for significant returns on their initial investment. Owning a home can be seen as a form of forced savings, as mortgage payments contribute to both equity and the potential for future financial gain.

Benefits of Renting

Flexibility and Mobility

Renting offers unparalleled flexibility and mobility. Individuals who value the ability to easily relocate for job opportunities or personal reasons may find renting to be a more suitable option. Lease terms are typically shorter than mortgage commitments, allowing renters to adapt their living situations to changing circumstances without the burden of selling a property.

Lower Upfront Costs

Renting generally requires lower upfront costs compared to homeownership. While homeowners often face substantial down payments, closing costs, and ongoing maintenance expenses, renters typically only need to cover a security deposit and possibly some utility or maintenance fees. This lower barrier to entry makes renting more accessible for those with limited savings or uncertain financial situations.

Maintenance and Repairs

Renters are often relieved of the responsibilities and financial burdens associated with home maintenance and repairs. Landlords are typically responsible for addressing issues such as plumbing, electrical problems, and structural repairs. This can be a significant advantage for individuals who prefer not to deal with the time and expenses associated with homeownership maintenance.

Diversification of Investments

Renters have the flexibility to invest their savings in alternative ways, such as stocks, bonds, or business ventures. While homeowners may have a substantial portion of their wealth tied up in their property, renters can diversify their investment portfolio more easily, potentially achieving a higher level of financial flexibility and risk management.

See Also: Blue World City Islamabad

Lower Financial Risk

Homeownership comes with inherent financial risks, particularly during economic downturns. Property values can fluctuate, and homeowners may find themselves underwater on their mortgages if the market experiences a downturn. Renters, on the other hand, are not directly exposed to these fluctuations, providing a level of financial insulation against real estate market volatility.

Conclusion

In the perpetual debate between owning a home and renting, there is no one-size-fits-all answer. The decision ultimately depends on individual circumstances, financial goals, and lifestyle preferences. Homeownership offers the allure of building equity, stability, and the pride of ownership, while renting provides flexibility, lower upfront costs, and freedom from maintenance responsibilities.

The key is to carefully evaluate personal priorities, long-term financial plans, and the current real estate market conditions. Whether one chooses the path of homeownership or renting, understanding the benefits and trade-offs of each option is crucial for making a well-informed decision that aligns with individual values and aspirations.